Revisiting 1972,

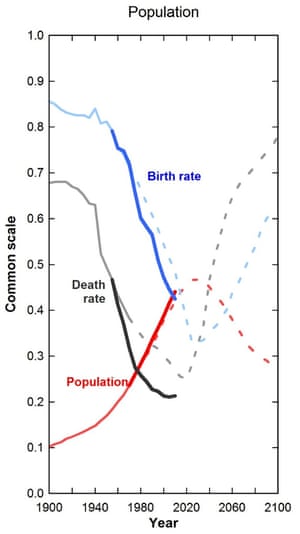

In the face of a media torrent of news about stock markets doing well, driverless cars about to change America, and a house full of appliances which will anticipate your every need and tell you when your unrequested-but-customary toast and coffee are ready, I would like to take your consciousness back to MIT 1972, where the third iteration of the most advanced systems-analysis computer model, World-3, produced the projected graphs below, of what our species would achieve on our planet, if we kept doing things about the same, without a concerted and global redirection of our efforts, "Business as Usual". Notice the red line on this graph, marking peak industrial output and food per person. It looks like it falls right about 2014 or 2015. This was not a "prediction", as the authors stated many times, but a forward projection of historical trends, with the interactions of the trends correlated into each other, rather than being projected in isolation, as if everything else would remain the same. World-1 and World-2 programs had been tested and retested, then further refined to develop World-3. Running the data with a start date of 1900 predicted the 20th century pretty well, including the part that had not yet happened. Limits to growth was a hot topic in 1971, the year that US oil production peaked, just as M. King Hubbert had predicted in the 1950s. We were feeling a lot of change then. I remember. We were surprised, and didn't want to be surprised again. Remember?

Move your gaze about halfway between that red line and the marker for 2020, down on the x-axis. that's where we are. That's where Wile-E-Coyote looks down.

China's Deng Xiaopeng was strongly influenced by this book. Remember China's one-child-policy? Ronald Reagan made a point of scorning this book in public speeches, saying there were "no limits". Peak oil was discredited in 2006, the year oil was to peak, by re-defining "oil". Look, no peak! (except the archaic definition of "oil" peaked that year) Saved by innovation! Will you be comforted by becoming a billionaire, when you are provided with a billion-dollar i-Phone, instead of a gold watch, retirement pay, Social Security and Medicare?

In 2010, the University of Melbourne rigorously analyzed the 1972 projections, overlaying best data from the intervening years to create these graphs. this 2014 article presents the data well. The graphs all show very impressive correlations. (Birth rate reduction from forecast is partly due to 1979 Chinese implementation of one-child-policy)

"You have been warned, the situation in the markets is much worse than you realize" This article targets investors, hence the first part is really a segue into the core message that insiders everywhere, in many industries, are saying that things are much worse than they look from the outside. This one graph is a little disorienting, unless you already know that we have been pumping shale oil on borrowed money, which can never be repaid. Big money across our planet is "taking-profits", not "investing in production".

https://srsroccoreport.com/you-have-been-warned-the-situation-in-the-markets-is-much-worse-than-you-realize/

Professor of Physical Chemistry, Ugo Bardi, at University of Florence (Italy, not Texas) explains The Seneca Effect, or "Seneca's Cliff". Seneca observed 2000 years ago that natural systems grew slowly and collapsed rapidly. That is what we face in our human-centric ecosystem now. That curve of collapse is shown above in the industrial output per capita, and other inflection points of the Limits to Growth graph.

There is a lot to consider about money, since the current definition of money is exponentially expanding debt, and it is about to massively default everywhere. Cryptocurrency is attractive, in that it is inherently limited in quantity, at least Bitcoin is. This could provide a new form of global currency in the reset, but no nation state will peacefully give up the right of seigniorage the use of the excess value from the initial creation of money. Therefore, we may have a lot of national cryptocurrencies. Some of these schemes could still include coins and bills, not requiring every transaction to be digital and recorded. (Governments can't let Bitcoin take over, but they can use it as a tool and weapon, as China did when it bought up so much Bitcoin mining and currency, and is now making it harder and harder to trade. China's government might soon provide the only legal trading platform for Bitcoin in China. Chinese were using Bitcoin to get their money out of China. China is now poised to dominate that situation, while also using Bitcoin against the $US in the coming currency wars.)

Charles sent this article about cultural norms and societal engagement styles in the cultures of the world. This is painted with broad strokes, and every society has a wide variety of personalities and talents in the mix. I can look at this, and myself, and think of some frustrations I have trying to collaborate on solving problems, with people who have very different styles.

Revisiting India

No comments:

Post a Comment