Trickled Upon,

Driving to Yoakum with Jenny, Friday night, I was thinking that we need an economics based on facts, something with more predictive-value than "the Fed's got your back", which is the rationale of the risk-asset Ponzi scheme instituted in early 2009.

Any workable economic model has to be based upon the actual "costs" of energy, since energy powers all production, communication, storage and transportation.

Energy "costs" are presently expressed in monetary terms, but money verges upon "undefined". Energy extraction costs energy. The EROI (energy return on energy invested) used to be as high as 100:1 for crude oil in the USA in the 1930s. For tar sands in Canada and Venezuela it is now about 3:1 , whereas it may be above 30 for some of the easily-extracted oil in Iran and Iraq. It is about 10:1 for wind and solar, though other problems with timing, transmission and network costs arise. Coal has an EROI of around 46, which is lower due to cheap strip mining, even though the quality of the coal keeps declining. This paper goes into EROI as an analytic tool for energy sources. https://www.sciencedirect.com/science/article/pii/S0301421513003856

Economy runs on the energy remaining after energy is "produced" in a directly usable form, like electricity or diesel fuel, which are high quality energy for manufacturing and transportation. 3 times as much coal is needed to put into a generator, which must exist and be maintained, to get one energy unit of electricity. Natural gas generation plants can turn on and off faster to keep the grid up when demand is high, but the plants still need to be made and maintained at significant cost. Europe has been used to high quality Russian oil and gas, for which their economy and infrastructure is specialized. They will have a higher cost using energy from other sources, due to transport and mismatch to infrastructure.

The energy costs of building solar cells and wind turbines are borne by fossil-fuel and mining economy. Neodymium, a rare-earth element, needed for efficient magnets in motors and generators, is very destructive to mine and refine. The environmental cost of a Toyota Prius or Nissan Leaf exceeds that of a Toyota Matrix over its lifetime of use, which is fairly well reflected in its inclusive lifetime cost. This is a case where monetary cost does reflect environmental and embedded-energy ("Emergy") costs.

I have often returned to this theme that we should invest any surplus of wealth we now have into things which will help provide for our needs in the future of less and more expensive fuel. I addressed this in "Surplus Energy Economy" July 4, 2020. https://www.johndayblog.com/2020/07/surplus-energy-economy.html

The article was from "Surplus Energy Economics" blog, which I last referenced on the 5th of this month https://drjohnsblog.substack.com/p/crystal-ball .

I'll be referring to this blog more frequently, as it provides the best analytical model for economics that I have been able to find, even though it is much less worked out than classical, or "neo-classical", "neoliberal" economics. Classical economics did look at efficiency of social-economy and valued the reduction of value extraction through "rent collection". "Neoclassical" and "neoliberal" economic models say that rent-collection is just as valuable as growing wheat; no-difference, nd that money-moving in credit card debt penalty charges is of the same economic value as money moving for natural gas to power kitchen stoves and on-demand electrical power plants for peak-load.

The predictive value of neoliberal economics is worse than nothing, because it is based upon a false and misleading premise, which has always been supported by rent-collecting wealth-interests, the "Rentier" capitalists. "GDP", gross domestic product replaced "GNP", gross national product, which was a manufacturing index,based on industrial production. Gross National Product would have better reflected classical economic theory if it had subtracted rents from industrial outputs, but at least it didn't add them in as wealth-created.

Thermoeconomics has long been used in industrial processes like making-cement and refining oil. We can look at broad thermoeconomic predictions more effectively than we can look at narrow specifics, except when we get to completely narrowed specifics in the efficiencies of a particular manufacturing process.

"In The Eye Of The Perfect Storm" is the latest primer from Surplus Energy Economics.

Industrial economy, "real economy" has "gone into reverse". It is not just growing more slowly. It has begun contracting, despite infusion of debt-money, which is promises made on future economic production. Future economic production is estimated to keep growing at 3.5% per year after it gets past the current bad patches of COVID-pandemic and War-in-Ukraine, but that 3.5% growth is already a false assessment. For the decade of 2009-2019 it was more like 1.3%, or even less, based on "prosperity" growth, real-economic growth. That lagged behind population growth in most places, though Chinese prosperity did advance per capita. Prosperity per capita has been in a 20 year decline in places like the US and UK. My personal assessment is that peak industrial economy occurred around Summer 2018. This article shows a carbon-emission peak around early 2019. https://www.nature.com/articles/s43017-022-00285-w

The banking repo-crisis in September 2019 reflected the inability of the biggest banks in the world to trust each other on overnight loans with US-Treasury debt as collateral, a systemic failure. The Fed stepped in to take on this function, pumping an estimated $2 trillion of promises of future wealth into the financial system before the end of 2019, as preparations for COVID-pandemic and financial direct-infusions to banking were both worked out in meetings in mid October 2019, on the same dates in New York, and the Wuhan (military olympic) Games were commencing.

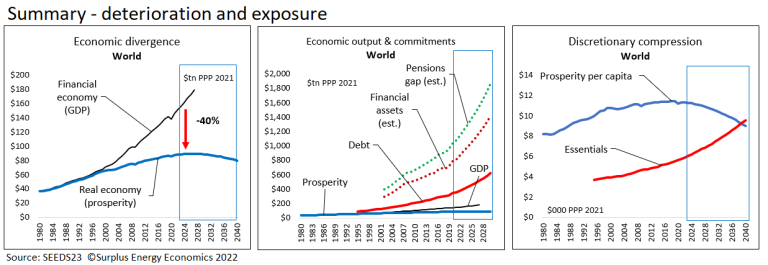

Through a thermoeconomics lens of real-economic contraction, which cannot be honestly reconciled with perpetual-growth economic theory, these events suggest narratives for crisis-management, while keeping the broken model of perpetual growth economy. Fiat-money promises future wealth for financial investment today, but those promises cannot be kept in real terms. The divergence can be seen in these graphs:

"Discretionary spending" is what is left over after essentials are purchased. This includes investments. As real prosperity contracts, especially per capita, discretionary spending falls fastest, since we all must buy food, fuel and housing first. We can see that all of the graphs that diverge from the blue of "prosperity" will have to collapse to meet that reality. GDP can be modified back to something more like GNP (better yet, with parasitic draws subtracted). Debt is something on the order of 10X real-economy, and real-economy is projected to keep contracting going forward, so this debt cannot even be "serviced" at some point in the near future. Interest rates are rising to defend the status of the $US currency, the basis of the western financial system, but that will cause massive defaults in debts. Pensions, to the degree that they are funded, are mostly funded through financial assets, stocks and bonds, which have been bid-up since 2009 in the "everything bubble", where "the Fed had your back". During the years of 2019 through to the present, there has been a further massive loss of ownership in the economy, except at the bllionaire level, where massive acquisition of productive assets has taken place. This has been the biggest wealth transfer ever, to the richest few elites, and coming before what must be the biggest financial crash ever, if financial reckoning is to approach reality, which it must.

The rest of the world has long undergone resource-extraction by the $US, trading real economic outputs for "printed" dollars, which they then spend on other real economic output, as the value of those dollars slowly fades away. The $US is a faith-based currency, based upon faith that $US will still buy things in 5-10 years, with a certain, mild lossiness (2% inflation "target"). Faith in the $US is more important for the owner class than continuing the current Ponzi scheme, so $US value must be supported first. For $US instruments and debts to approach reality, the losses of asset-value will be most readily accomplished through a stock-market crash and bond crash. It looks like 90% is the right order of magnitude. Commercial debt will also default, and consumers will default on much of their debt. Countries that don't print their own currencies will default. Pensions will be unfunded, and this will be addressed in the context of falling real economy, which makes pensions seem unrealistic.

The financialized west has the biggest problem here, since the postwar social contract has been based upon retirement security. The easiest thing for the financiers would be if most people would die before collecting their pensions. This has been brought up in the context of COVID-19, and of COVID-vaccine-products increasing mortality and appearing to progressively weaken immune systems against other infections and cancer-surveillance, destroying newly-mutated pre-cancerous cells before they grow into cancers. Famine is being staged throughout the world now, as is a war which is really between the 2 most nuclear-armed militaries in the world, with Ukraine as a proxy for the US/NATO.

The possibilities for elimination of any number of humans are all on the table, and the possibility for economically constraining or eliminating any single human is being worked on. In China, which is having a banking crisis, lockdowns kept people from going to their banks, and when lifted, health-passes turned RED when people traveled to their banks, so they had to return home, and could not get money or answers.

In the EU, we see Germany and other countries opening up the mothballed coal-fired power plants (highest EROI, highest pollution). "This is a temporary measure because of the war". The war justifies whatever needs to be done, without the admission of having lied.

The World Is Failing In Both Energy Affordability And Climate Goals Can the same people who lied announce that they lied? Probably not. It would be a new thing. The development of a new global trade currency, based upon commodities (real economic production), and independent of "siegniorage" benefits to a country printing fiat-currency, would free all other countries of paying that particular economic rent. That currency would offer a parallel economic option, which would allow countries to default on $US debt, and also to tell foreign oil and mining companies that they no-longer had any claims on wells and mines, that those now belonged to the people of Venezuela, Iran and Peru, for instance.

The threat to any country repudiating $US debt and foreign-ownership of national-resources and assets is the US/NATO military alliance, which does not "win" much lately, but inflicts severe pain and hardship upon countries like Iraq, Syria, Libya, Iran and Venezuela, whch fail to subordinate their national interests to the western financial empire.

The War in Ukraine continues to erode that threat. It is seen that western industry is no longer able to sustain the full production to supply a major war, as it did in Korea and Vietnam. Russian industry seems completely capable of this.

.. In short, US annual artillery production would at best only last for 10 days to two weeks of combat in Ukraine. If the initial estimate of Russian shells fired is over by 50%, it would only extend the artillery supplied for three weeks.

The US is not the only country facing this challenge. In a recent war game involving US, UK and French forces, UK forces exhausted national stockpiles of critical ammunition after eight days.

The US is not the only country facing this challenge. In a recent war game involving US, UK and French forces, UK forces exhausted national stockpiles of critical ammunition after eight days.

Venezuela has been granted a special dispensation to sell heavy crude to Germany, which has one refinery that can be configured to refine it. (Venezuela still does not get the national gold back from London, though.) This can be decreed by the US because the US Navy does effectively rule the ocean shipping lanes. How long the control of shipping lanes by the "Atlanticist" powers may continue is in question. If the $US loses primacy suddenly, this will be unaffordable. In a longer monetary/trade contest, the US Navy would be a priority.

This book review states the case for waning US naval dominance.

The faith-based global financial system must retain the faith of the wealthy elites, not only workers saving for retirement. The G-7 countries have just banned buying Russian gold, but Switzerland is not a mamber, and there is still no accounting for who took delivery of over 3 tons of Russian gold that entered Switzerland in May. (Financial elites feather their own nests. They might voice nationalist loyalties when it serves their interests.) It remains possible that this gold in Switzerland may correspond to Russian gold in other locations, such as Singapore, which could be there to backstop the "Golden Ruble" when it makes it's debut, and free of direct Rusian involvement.

Most of the countries in the world are not G-7 members and would like to have Russian oil and gold. https://www.zerohedge.com/markets/biden-g-7-will-ban-russian-gold-imports

It is reasonable to expect global financial elites to be prepared to have hedged their bets going into a global financial regime change, which is inevitable, but uncertain as to timing and ultimate format. How soon might they jump ship? If the regime is really about to change, the first to jump will get the most rewards, and the late-jumpers will lose out. The early jumpers could also lose "bigly"...

For those of us who are financial peons, decisions are more real-world than financial/monetary. We all have finances and expenses, bills and debts. We can work to get out of debt as the best investment, then invest in things which will be of direct useto us in a lower energy future, like vegetable gardens, getting in shape by practicing bicycle transit, lowering our energy needs for comfort and fuel, and contributing to healthy families and friendship relations.

All of these have supported humans through history. The days of relying solely upon financial support to cover all needs are ending.

A risk for us is to take the bait of free electronic money on the path to the end of the chute where we will have no choices and no ability to wiggle free.

Another risk is to take in chemicals or medicines which will weaken or kill us in time, anything from Diet-Coke to Pfizer/Moderna products.

We can invest in eliminating debts and addictive habits, and working on our own projects to build a decent human future.

Non-Financial Planner

(shown cutting up cornstalks in June which seems like August)

No comments:

Post a Comment