Fellow "Muppets",

Technically, the cutoff for SIFIs is $250 billion in assets. However, the reason they are called “systemically important” is not their asset size but the fact that their failure could bring down the whole financial system. That designation comes chiefly from their exposure to derivatives, the global casino that is so highly interconnected that it is a “house of cards.” Pull out one card and the whole house collapses. SVB held $27.7 billion in derivatives..

..As of the third quarter of 2022, according to the “Quarterly Report on Bank Trading and Derivatives Activities” of the Office of the Comptroller of the Currency (the federal bank regulator), a total of 1,211 insured U.S. national and state commercial banks and savings associations held derivatives, but 88.6% of these were concentrated in only four large banks: J.P. Morgan Chase ($54.3 trillion), Goldman Sachs ($51 trillion), Citibank ($46 trillion), Bank of America ($21.6 trillion), followed by Wells Fargo ($12.2 trillion). A full list is here. Unlike in 2008-09, when the big derivative concerns were mortgage-backed securities and credit default swaps, today the largest and riskiest category is interest rate products.

The original purpose of derivatives was to help farmers and other producers manage the risks of dramatic changes in the markets for raw materials. But in recent times they have exploded into powerful vehicles for leveraged speculation (borrowing to gamble). In their basic form, derivatives are just bets – a giant casino in which players hedge against a variety of changes in market conditions (interest rates, exchange rates, defaults, etc.). They are sold as insurance against risk, which is passed off to the counterparty to the bet. But the risk is still there, and if the counterparty can’t pay, both parties lose. In “systemically important” situations, the government winds up footing the bill.

Like at a race track, players can bet although they have no interest in the underlying asset (the horse). This has allowed derivative bets to grow to many times global GDP and has added another element of risk: if you don’t own the barn on which you are betting, the temptation is there to burn down the barn to get the insurance. The financial entities taking these bets typically hedge by betting both ways, and they are highly interconnected. If counterparties don’t get paid, they can’t pay their own counterparties, and the whole system can go down very quickly, a systemic risk called “the domino effect.”

Another time bomb in the news is Credit Suisse, a giant Swiss derivatives bank that was hit with an $88 billion run on its deposits by large institutional investors late in 2022. The bank was bailed out by the Swiss National Bank...

A few bank bankruptcies are manageable, but an interest rate shock to the massive derivatives market could take down the whole economy...

Certainly, for our local government deposits, public banks are an important solution. State and local governments typically have far more than $250,000 deposited in SIFI banks, but local legislators consider them protected because they are “collateralized.” In California, for example, banks taking state deposits must back them with collateral equal to 110% of the deposits themselves. The problem is that derivative and repo claimants with “supra-priority” can wipe out the entirety of a bankrupt bank’s collateral before other “secured” depositors have access to it...

Bank of America, Citigroup, JPMorgan Chase and Wells Fargo announced today they are each making a $5 billion uninsured deposit into First Republic Bank.

Goldman Sachs and Morgan Stanley are each making an uninsured deposit of $2.5 billion. (Well, that is the Big-5 derivative banks there.)

BNY-Mellon, PNC Bank, State Street, Truist and U.S. Bank are each making an uninsured deposit of $1 billion, for a total deposit from the eleven banks of $30 billion.

This action by America’s largest banks reflects their confidence in First Republic and in banks of all sizes, and it demonstrates their overall commitment to helping banks serve their customers and communities.

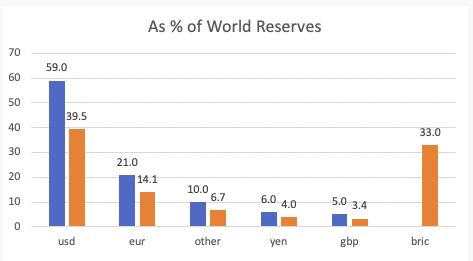

What seems to be crystal clear is that the path toward a new financial system designed essentially by Russia-China, and adopted by vast swathes of the Global South, will remain long, rocky, and extremely challenging. The discussions inside the EAEU and with the Chinese may extrapolate to the SCO and even towards BRICS+. But all will depend on political will and political capital jointly deployed by the Russia-China strategic partnership.

That’s why Xi’s visit to Moscow next week is so crucial. The leadership of both Moscow and Beijing, in sync, now seems to be fully aware of the two-front Hybrid War deployed by Washington.

This means their peer competitor strategic partnership – the ultimate anathema for the US-led Empire – can only prosper if they jointly deploy a complete set of measures: from instances of soft power to deepening trade and commerce in their own currencies, a basket of currencies, and a new reserve currency that is not hostage to the Bretton Woods system legitimizing western finance capitalism.

Although the Beijing statement primarily addresses issues related to diplomatic rapprochement, Iranian-Saudi understandings appear to have been brokered mainly around security imperatives. Supporters of each side will likely claim their country fared better in the agreement, but a deeper look shows a healthy balance in the deal terms, with each party receiving assurances that the other will not tamper with its security.

While Iran has never declared a desire to undermine Saudi Arabia’s security, some of its regional allies have made no secret of their intentions in this regard. In addition, MbS has publicly declared his intention to take the fight inside Iran, which Saudi intelligence services have been doing in recent years, specifically by supporting and financing armed dissident and separatist organizations that Iran classifies as terrorist groups.

The security priorities of this agreement should have been easy to spot in Beijing last week. After all, the deal was struck between the National Security Councils of Saudi Arabia and Iran, and included the participation of intelligence services from both countries. Present in the Iranian delegation were officers from Iran’s Ministry of Intelligence and from the intelligence arms of the Islamic Revolutionary Guard Corps (IRGC).

On a slightly separate note related to regional security — but not part of the Beijing Agreement — sources involved in negotiations confirmed to The Cradle that, during talks, the Saudi delegation stressed Riyadh’s commitment to the 2002 Arab peace initiative; refusing normalization with Tel Aviv before the establishment of an independent Palestinian state, with Jerusalem as its capital. What is perhaps most remarkable, and illustrates the determination by the parties to strike a deal without the influence of spoilers, is that Iranian and Saudi intelligence delegations met in the Chinese capital for five days without Israeli intel being aware of the fact. It is perhaps yet another testament that China — unlike the US — understands how to get a deal done in these shifting times.

https://thecradle.co/article-view/22445/exclusive-the-hidden-security-clauses-of-the-iran-saudi-deal

The statement also noted that Wednesday is the "anniversary of the conflict" which started 12 years ago in March 2011. Assad emerged victorious especially with Russia's help, given the the Russian military intervention at the invitation of the Syrian leader in 2015...

Assad was received by Putin’s special representative for the Middle East, Mikhail Bogdanov, at Moscow’s Vnukovo international airport.

Prior to a deadly Feb. 6 earthquake that killed 50,000 people in Turkey and Syria, Russia had been mediating talks between the two quake-hit countries.

Turkish representatives are expected to be present for events related to Assad's visit, with The Associated Press detailing that "The Syrian, Turkish and Russian deputy foreign ministers as well as a senior adviser to their Iranian counterpart are also set to hold talks Wednesday and Thursday in Moscow to discuss 'counterterrorism efforts' in Syria."

The interviewer to Lauterbach:

“So, you’ve always given the impression that side-effects aren’t really a thing.“

With respect to severe COVID-19 ‘vaccine’-induced injuries, Lauterbach stated:

“I’ve always been aware of the numbers. They have remained relatively stable. …1:10,000: some may say that’s a lot, and some may say it’s not that much.“

Despite exaggerated local media reports of strong winds at noon on Wednesday, February 22, the weather conditions posed no threat to flying, which raises serious questions of why the company-owned plane crashed within a minute of clearing Runway 18 at the Bill and Hillary Clinton National Airport. The irregularities surrounding the air-crash included an official cover-up of the actual crash location inside a 3M industrial complex, suspension of phone reception at Little Rock 911 and blatant disinformation by the Gannett newspaper group on the ill-fated Beechcraft’s destination.

Thus far, a review of that midair blast along with the registered flight destination suggests that the CTEH team was targeted for elimination under the pervasive Biden cover-up of chemical warfare agents in the tanker cars destined for secret use in Ukraine, which instead derailed at East Palestine, Ohio. Crashing a short distance from takeoff, the Beech BE20, an upgraded Beechcraft 200 Super King Air, which has an excellent reputation for flight performance and air safety, was blown to shreds midair before its fiery nose-dive into a 3M factory warehouse on the north end of the complex, barely averting a highway pile-up on Route 440, the link road between I-40 and I-30...

..Just prior to noon on Wednesday, February 22, toxic site inspectors Micah Kendrick, Kyle Bennett, Gunter Beaty, and Glenmarkus Walker boarded the CTEH-owned twin-engine Beech BE20 (a 9-passenger business version of a Beechcraft 200 Super King Air) at the Bill and Hillary Clinton National Airport in Little Rock, Arkansas. Earlier predictions of light rainfall had not materialized and winds from the southwest were subsiding to below 40 mph. On takeoff from Runway 18, which is reserved for small aircraft, pilot Sean Sweeney planned to keep the plane climbing toward the south, into the wind, with the aim of circling leftward over the Arkansas River onto a northeasterly flight path toward Ohio with the added advantage of a tailwind. All systems were go, there was no cause for concern at takeoff.

After clearing the runway, at the start of ascent along a straight line and immediately after crossing the Highway 40 bypass (which connects I-40 with I-30), less than a mile from takeoff, the BE20 was suddenly blown to bits by a powerful explosion. The fragmenting plane nose-dived toward the rear of the 3M industrial complex, crashing through the roof of a large warehouse with truck-loading docks. A pillar of black smoke from burning aircraft fuel rose into the gray sky, and was caught on video by a nearby weather helicopter. The steep fast dive allowed no time for a bail-out by the passengers or pilot, who were likely killed in the powerful blast or within a few seconds after being crushed on impact.

Meanwhile, as an emergency crew closed off the 3M grounds and hosed the flames, another team from an as-yet identified agency set up a fake crash-site farther south in a junkyard, hauling pieces of wreckage to that decoy site for reporters to snapshoot.

No comments:

Post a Comment